Getting My Stonewell Bookkeeping To Work

The Ultimate Guide To Stonewell Bookkeeping

Table of ContentsStonewell Bookkeeping for BeginnersThe 8-Minute Rule for Stonewell BookkeepingStonewell Bookkeeping Fundamentals ExplainedThe smart Trick of Stonewell Bookkeeping That Nobody is DiscussingStonewell Bookkeeping Fundamentals Explained

Instead of going with a declaring closet of various records, billings, and invoices, you can offer thorough documents to your accounting professional. After utilizing your accounting to submit your taxes, the IRS may choose to carry out an audit.

That funding can come in the form of owner's equity, grants, company lendings, and investors. But, investors need to have a good concept of your organization prior to spending. If you don't have audit records, investors can not determine the success or failure of your firm. They require current, precise info. And, that information needs to be easily available.

Not known Details About Stonewell Bookkeeping

This is not planned as legal advice; for even more information, please go here..

We responded to, "well, in order to know just how much you require to be paying, we need to know just how much you're making. What are your earnings like? What is your web income? Are you in any type of financial debt?" There was a long time out. "Well, I have $179,000 in my account, so I think my earnings (earnings less expenses) is $18K".

Some Ideas on Stonewell Bookkeeping You Should Know

While maybe that they have $18K in the account (and even that may not be true), your balance in the bank does not necessarily identify your revenue. If a person got a grant or a loan, those funds are not considered revenue. And they would not function into your earnings statement in identifying your profits.

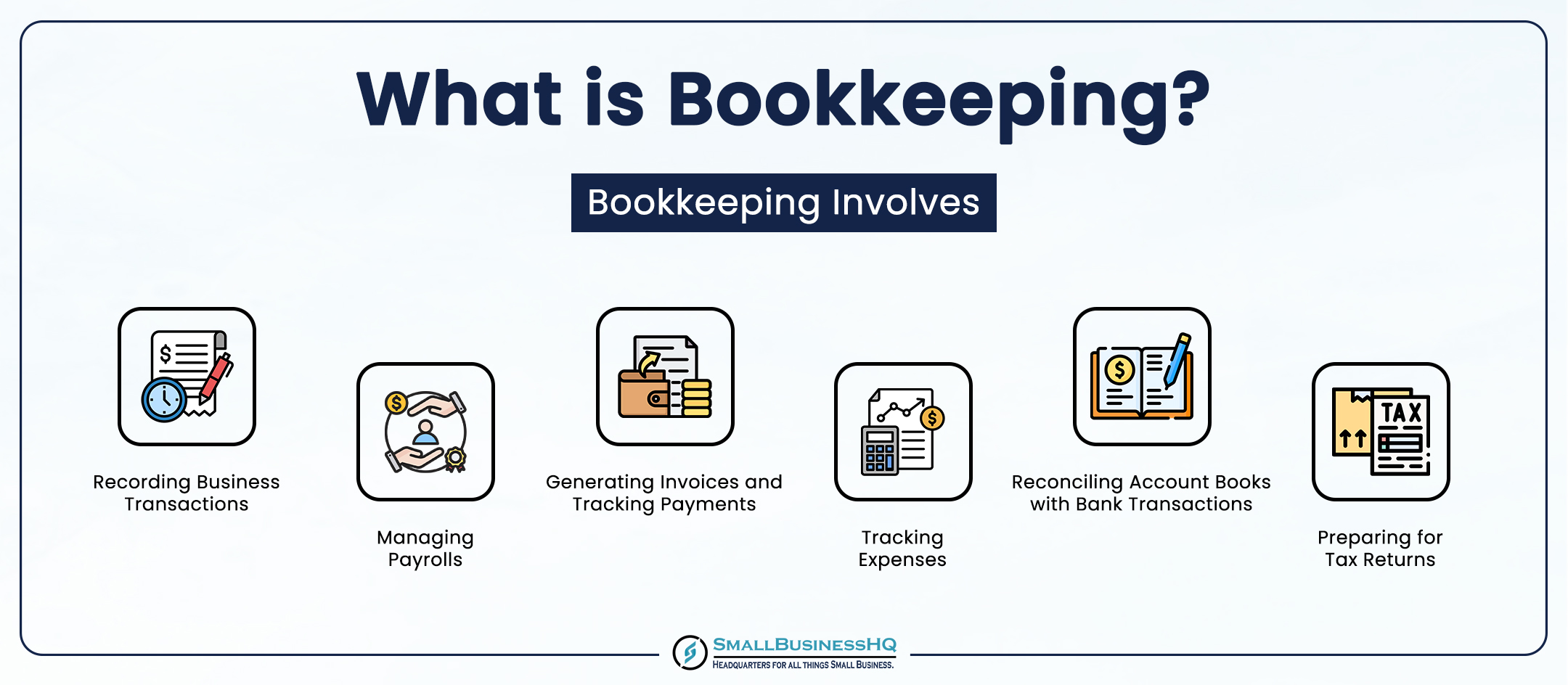

Many things that you believe are costs and reductions are in reality neither. Accounting is the procedure of recording, identifying, and arranging a business's monetary deals and tax filings.

A successful organization needs assistance from specialists. With practical objectives and an experienced accountant, you can quickly attend to difficulties and keep those worries away. We're right here to help. Leichter Accountancy Services is a seasoned CPA firm with an enthusiasm for bookkeeping and dedication to our customers - franchise opportunities (https://peatix.com/user/28565535/view). We dedicate our power to guaranteeing you have a strong financial foundation for development.

The Greatest Guide To Stonewell Bookkeeping

Precise bookkeeping is the foundation of excellent monetary management in any kind of organization. With excellent accounting, companies can make much better choices since clear economic documents use useful information that can assist technique and improve revenues.

Solid accounting makes it easier to safeguard funding. Exact monetary declarations develop next page depend on with loan providers and capitalists, increasing your chances of getting the capital you need to grow. To preserve strong monetary health and wellness, services need to regularly integrate their accounts. This means matching transactions with bank declarations to capture errors and stay clear of economic disparities.

They guarantee on-time payment of expenses and fast customer settlement of billings. This boosts capital and helps to avoid late fines. A bookkeeper will certainly cross bank declarations with internal records at the very least as soon as a month to discover mistakes or variances. Called financial institution settlement, this procedure ensures that the financial records of the company suit those of the bank.

They monitor current pay-roll data, subtract tax obligations, and figure pay scales. Bookkeepers create fundamental financial reports, including: Earnings and Loss Declarations Reveals income, costs, and web profit. Equilibrium Sheets Details possessions, obligations, and equity. Capital Declarations Tracks cash activity in and out of business (https://hirestonewell.bandcamp.com/album/stonewell-bookkeeping). These records assist company owner understand their monetary position and make informed choices.

Some Known Details About Stonewell Bookkeeping

While this is cost-efficient, it can be taxing and prone to mistakes. Tools like copyright, Xero, and FreshBooks enable organization proprietors to automate accounting jobs. These programs aid with invoicing, bank reconciliation, and monetary reporting.